Resources

ATM Locator

Plus, Pulse, Co-Op, Interlink

Click below to search ATM locations

For Sale

Audio Teller

Not an app user? Sign up for Audio Teller to stay up to date on your account 24/7. You must call the Credit Union first to enable, then call 1-833-440-4240 to set up your PIN. You can check balances, transfer funds, check loan rates and more!

Fraud Prevention:

Stay in the know and check your credit report often to safeguard yourself from identity theft, request your free credit report at annualcreditreport.com

We want our members to have a wealth of financial knowledge please visit Consumer Tips | MyCreditUnion.gov to learn more about Fraud Prevention. Also learn about the latest scams and view a glossary of financial terms (plus many additional topics of information) to arm yourself with the resources you need to protect and manage your finances.

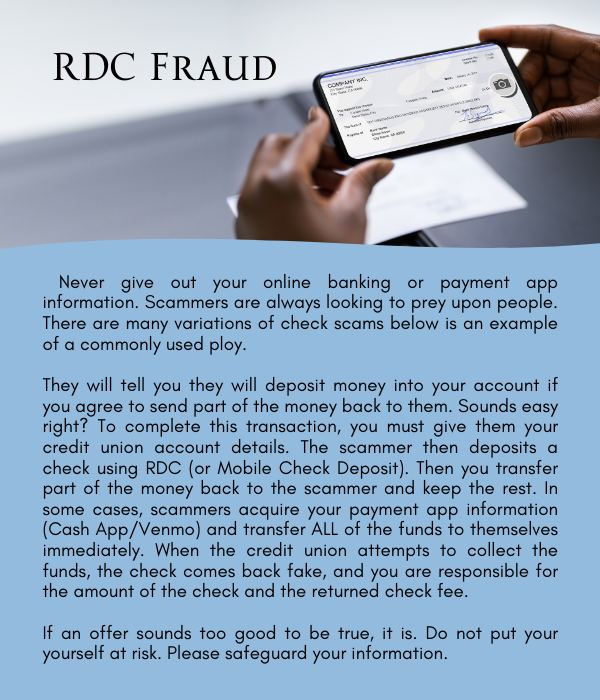

Fraud Tips:

To learn more about how to protect yourself from fraud and scams, visit the helpful links below. If you believe you have been a victim of a scam, please contact the credit union immediately.

Money Mules

https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams/money-mules

Spoofing and Phising

Common Frauds and Scams

https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams

Forms

Privacy Notice

Rev. 9/2025

| FACTS |

WHAT DOES GREAT LAKES FIRST FEDERAL CREDIT UNION DO WITH YOUR PERSONAL INFORMATION?

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect, and share depend on the product or service you have with us. This information can include: -Social Security number and account balances -credit history and mortgage rates and payments -payment history and wire transfer instructions When you are no longer our member, we continue to share your information as described in this notice. |

| How? | All financial companies need to share members’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their members’ personal information; the reasons Great Lakes First Federal Credit Union chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does Great Lakes First Federal Credit Union share? | Can you limit this sharing? |

| For our everyday business purposes— such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes— to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | Yes | No |

| For our affiliates’ everyday business purposes— information about your transactions and experiences | No | We don’t share |

| For our affiliates’ everyday business – information about your creditworthiness | No | We don’t share |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call 906-786-4623 or go to www.glffcu.com |

| What we do | |

| How does Great Lakes First Federal Credit Union protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does Great Lakes First Federal Credit Union collect my personal information? | We collect your personal information, for example, when you -open an account or deposit money -make a wire transfer or show your government-issued ID -apply for financing We also collect your personal information from others, such as credit bureaus, affiliates, or other companies |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only -Sharing for affiliates’ everyday business purposes— information about your creditworthiness -affiliates from using your information to market to you -sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. –Great Lakes First Federal Credit Union has no affiliates. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. – Great Lakes First Federal Credit Union does not share with our nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. – Our joint marketing partners include insurance companies. |